Affordable Housing Supplementary Planning Document

Affordable Housing Supplementary Planning Document

Adopted February 2022

Content

What is a Supplementary Planning Document?

What is the Purpose of this SPD?

When Does this Guidance Apply?

Encouraging the Efficient Use of Sites

Types of Residential Development

Mix of Dwelling Sizes and Tenures

Occupancy Restrictions and Local Connections Criteria

Agricultural, Forestry and Other Workers Requiring Rural Accommodation

Self and Custom Build Proposals

Acceptance of Financial Contributions

Calculating the Financial Contribution

Section 106 Agreements and Unilateral Undertakings

Proposals without a Registered Provider

Delivery within Small or Isolated Sites

Appendix 1: Affordable Housing Scheme Template

1. Introduction

What is a Supplementary Planning Document?

1.1 The role of Supplementary Planning Documents (SPD) is to provide guidance on the application of existing policies within an adopted development plan. The SPD does not form part of the development plan nor is it intended to provide policies beyond those within the development plan. The overall purpose of this SPD is to assist the interpretation and application of those policies within the Rushcliffe Local Plan Part 1: Core Strategy and Local Plan Part 2: Land and Planning Policies which have implications for the delivery of affordable homes within the Borough.

1.2 The National Planning Policy Framework (2021) (NPPF) and Planning Practice Guidance (PPG) contain policies and detailed guidance on the delivery of affordable housing. This SPD also interprets the NPPF and PPG, providing local context that will assist all parties when preparing or considering planning applications.

What is the Purpose of this SPD?

1.3 This guidance is for all persons with an interest in the delivery of affordable housing within Rushcliffe, including planning officers, Borough councillors, developers and members of the public. The SPD will assist in the determination of planning applications, provide an overview of current best practice guidance and have a role in the delivery of affordable housing where the development is acceptable in planning terms. It encourages pre-application engagement with the Council, sets out what information the Council expects to be included within proposals which either require a proportion of affordable homes (as set out in the adopted Local Plan) or are 100% affordable housing (for example within rural exception sites), the planning requirements which the Council consider necessary for a policy compliant proposal, and delivery requirements which will be set out in legal agreements.

National Policy Context

1.4 Chapter 5 of the National Planning Policy Framework (NPPF) (2021) confirms the importance of significantly boosting the supply of homes and delivering housing needed for different groups in the community, including those who require affordable housing.

1.5 Paragraph 41 specifically highlights the benefits of resolving affordable housing issues at the pre-application stage.

1.6 Paragraph 63 states that planning policies should specify the type of affordable housing required, and expect it to be met on-site unless:

- off-site provision or an appropriate financial contribution in lieu can be robustly justified; and the agreed approach contributes to the objective of creating mixed and balanced communities.

1.7 Paragraph 64 states that the ‘provision of affordable housing should not be sought for residential developments that are not major developments…’ and in order ‘to support the re-use of brownfield land, where vacant buildings are being reused or redeveloped, any affordable housing contribution due should be reduced by a proportionate amount.’

1.8 Affordable housing now comprises a range of housing tenures, including both homes for rent and an increasing number of different housing products that facilitate home ownership (including shared ownership, rent-to-buy, Starter Homes and Discount Market Sales). The Government has also included First Homes as a specific kind of discounted market sale housing within the definition of affordable housing. These will be sold at no less than a 30% discount of market value and comprise a minimum of 25% of all the affordable homes

provided [First Homes Planning Practice Guidance]. The national planning policy definition of affordable housing is included in the Glossary (Annex 2) of the NPPF, it states that affordable housing is:

Housing for sale or rent, for those whose needs are not met by the market (including housing that provides a subsidised route to home ownership and/or is for essential local workers); and which complies with one or more of the following definitions:

- Affordable Housing for Rent (in accordance with the Government’s policy on Social Rent or Affordable Rent, or at least 20% below market rents); Starter homes;

- Discounted market sales housing (sold at a minimum of 20% discount (or minimum of 30% if the property is a First Home)); and

- Other affordable routes to home ownership (including shared ownership and rent to buy);

Categories b, c and d being collectively referred to Affordable Housing for Sale in the NPPF Annex 2. These affordable ownership tenures are also referred to as intermediate housing.

1.9 Subject to policies within the adopted Local Plan, affordable housing must comprise at least one of these types of tenure.

1.10 Paragraphs 72, 78 and 149 address exceptions sites. They encourage local planning authorities to support both entry-level exception sites for first time buyers and rural exception sites for affordable housing on land which is not allocated for housing and which is adjacent to settlements. Entry-level exception sites however should not be larger than one hectare or exceed 5% of the size of the existing settlement, or compromise protected areas within the NPPF (such as Green Belt or in areas at risk of flooding [Footnote 6 of the NPPF includes a more comprehensive list of areas or assets which should be protected]). In order to facilitate their delivery some market housing on exception sites can be considered.

1.11 Where a rural exception site for affordable housing is located within the Green Belt, unlike open market housing and entry-level exception sites, rural exception sites for affordable housing are appropriate, provided the development plan contains policies for such sites. In accordance with the NPPF, entry-level exception sites for first time buyers however, should not be permitted within the Green Belt unless there are very special circumstances.

Local Policy Context

1.12 Informed by the Strategic Housing Market Assessment (2012), Policy 8 within Local Plan Part 1: Core Strategy requires housing developments of 5 dwellings or more or 0.2 hectares or more provide for a proportion of affordable housing. However, in accordance with paragraph 64 of the NPPF (2021) (see paragraph 1.7 above), the Council will only seek a proportion of affordable housing within

major residential developments which are defined as those of 10 or more dwellings or sites which are of 0.5 hectares or more.

1.13 Policy 8 identifies different proportions of affordable housing within the following housing submarkets:

- Strategic Sites (Policies 20 to 25) - up to 30%

- West Bridgford, Rushcliffe Rural, Radcliffe, Gamston, Ruddington and Compton Acres - 30%

- ‘Leake’, Keyworth and Bingham - 20%

- Cotgrave - 10%

1.14 These proportions have been determined according to viability of housing developments within each submarket. They will be sought within the sites allocated for housing in Local Plan Part 2, Neighbourhood Plans and ‘windfall’ developments which meet the size threshold, unless there is robust, up-to-date evidence to suggest a different proportion of affordable housing. Both the assessment of allocations within the Local Plan and planning applications accord with Government practice guidance on viability [Planning Practice Guidance on Viability].

1.15 Part 5 of Policy 8 outlines how the mix of affordable housing will be determined by:

- Evidence of housing need, including; where appropriate; housing tenure, property type and size;

- The existing tenure mix in the local area;

- The ability to deliver affordable housing alongside other requirements, taking into account broad assessments of viability. Where the findings of local assessments are disputed on a particular site, a financial appraisal of the proposal will be expected in order to determine an appropriate level of affordable housing; and

- The availability of subsidy on a development to deliver affordable housing within weaker housing submarkets.

1.16 Policy 8’s supporting paragraph 3.8.9 states that, as identified within the Strategic Housing Market Assessment, of the total proportion of affordable housing 42% should be intermediate housing, 39% should be affordable rent and 19% should be social rent.

1.17 Based on the outputs of the Strategic Housing Market Assessment Update (2012) which includes existing and future needs, the Council has used a housing needs model to determine compliance with Policy 8, specifically the number of different housing types and their tenures within each development.

Local Plan Reviews

1.18 Should Local Plan Policy 8 and supporting Strategic Housing Market Assessment be superseded by more up-to-date policies and evidence, guidance within this SPD which remains consistent with a new Local Plan will continue to be used to determine planning applications. An updated Housing Needs Assessment has been published and will inform affordable housing policies in the new Local Plan, however it has not been tested through the plan making process. Consistency with a new Local Plan will be established through a review of this Supplementary Planning Document.

When Does this Guidance Apply?

1.19 This guidance applies to all schemes in the Borough that generate a need to provide affordable housing in accordance with paragraph 63 of the National Planning Policy Framework or, if justified during Local Plan Review, an up-to-date Local Plan policy that establishes a bespoke development threshold for the Borough.

Early Engagement

1.20 We recommend that development proposals be discussed with the Council’s Strategic Housing Team before a planning application is submitted to identify and resolve any issues at an early stage. The Strategic Housing Team can advise on the tenure and housing type mix and design of policy compliant schemes which meet housing need, as well as capital funding available to support scheme viability. There is no charge for this advice. The Strategic Housing Team can be contacted by phoning 0115 981 9911 or emailing

affordablehousing@rushcliffe.gov.uk.

1.21 In addition, the Council’s Planning and Growth Team can provide pre-application planning advice; this is a fee charging service. Further information can be found on the pre-application webpage.

2. Affordable Housing: Onsite Provision

Encouraging the Efficient Use of Sites

2.1 To ensure delivery of affordable housing, the Council require that they will be provided on site alongside the open market housing. Discussions regarding alternative off-site delivery on a ‘donor site’, or, as a last resort, commuted sums (financial payment) will take place only in exceptional circumstances. Chapter 3 (Financial Contributions) sets out these circumstances in further detail.

2.2 The capacity of sites in the Borough to accommodate development will depend on a number of factors, for example the character of the surrounding area, particularly within conservation areas where a lower density may be required. Where there is no requirement for a lower density, residential developments should make appropriate and efficient use of the site. The Council will examine closely those proposals which avoid affordable housing contributions as a result of lower density developments. Proposals which could, but do not make efficient use of land and avoid affordable housing contributions (for example, by providing uncharacteristically large plot sizes, and/or failing to provide smaller dwellings to meet identified housing needs), will be considered contrary to Paragraph 124 of the NPPF.

2.3 Developers may not circumvent requirements to efficiently use a site by artificially subdividing sites. The development site itself (as identified by the ‘red line’) should include all existing elements of built development that are being materially modified (e.g. extended, reconfigured or converted). As such, any existing dwelling or building on a plot proposed for development should only be excluded if there is no material alteration to that building proposed. If there are changes to the access, garden or parking to an existing dwelling or building that is necessary for the wider development to go ahead, the Borough Council may conclude that the land and building in question form part of the same development site.

2.4 Should two or more separate planning applications come forward the Borough Council will, in accordance with case law [R (Westminster City Council) v First Secretary of State and Brandlord Ltd [2013]], consider whether the sites are in the same ownership, whether they constituted a single site for planning purposes and whether the proposals could be deemed to constitute a single development. The Borough Council will, in such cases, consider evidence including land transaction data, the closeness in time of the applications being made, and appropriate evidence of ownership at the times the respective applications were made.

Types of Residential Development

2.5 Policy 8 part 4 within Local Plan Part 1 requires new residential development provide a proportion of affordable housing (if they exceed the threshold for contributions). In accordance with a recent High Court judgement [ Rectory Homes Limited v SSHCLG and South Oxfordshire District Council [2020] EWHC 2098]5, this requirement applies to both proposals within Use Classes C2 (residential

institutions) and C3 (dwelling houses). Consequently, proposals for C2 retirement accommodation which provide on-site care will also be expected to make an affordable housing contribution in accordance with the Local Plan depending on the self-containment of the residential dwellings and the scale of independent living they provide. Use Class C2 also includes nursing homes, hospitals, residential colleges and training centres, however as these do not comprise separate self-contained dwellings, they are not required by Policy 8 to

make a contribution.

2.6 As nursing homes are excluded from this requirement, the Borough Council will determine, on a case by case basis, whether the residential development comprises individual self-contained dwellings that provide independent retirement accommodation and therefore where a contribution is required or if it is a nursing home, where it is not.

2.7 Elements to consider when making the judgement include:

- Built form of the development (e.g. scale, facilities provided such as private kitchens and/or lounge, dwelling types, dwelling features (e.g. individual front doors), building standards);

- Provision of meals (either within a communal dining area or provided to residents’ rooms) and other services (is it linked to the needs of the individual’s personal care);

- Provision of communal facilities (kitchen, social areas, therapy rooms, offices and other areas for staff); and

- Whether residents individually own their accommodation or are contracted for a specific room.

2.8 It is necessary to look at the interrelationship between the dwellings and the rest of the development, taking into account the primary purpose of the development as a whole.

Affordable Tenure Types

2.9 ‘Affordable housing’ is an umbrella term that covers housing provided to eligible households whose needs are not met by the market, with eligibility based on local incomes and local house prices. This includes a number of different ownership and/or rental options, referred to in this document as tenures. The main types of affordable housing are ‘social rented’, ‘affordable rented’, referred to as Affordable Housing for Rent (NPPF)and Affordable Housing for Sale, referred to as ‘intermediate’ affordable housing within the Local Plan Part 1:Core Strategy.

- Social rented housing is owned by Registered Providers (as defined in section 80 of the Housing and Regeneration Act 2008), for which guideline target rents are determined through the national rent regime. It may also be owned by other persons and provided under equivalent rental arrangements to the above, as agreed with the local authority or with Homes England / Regulator of Social Housing.

- Affordable rented housing is owned by Registered Providers and must be rented at no more than 80 per cent of the local market rent (including service charges, where applicable). It should also be provided at a level of rent (and any additional service charge) which does not exceed the Local Housing Allowance (LHA) for the relevant area.

- Affordable Housing for Sale (or intermediate housing) is a generic description covering those tenures that enable home ownership. Whilst the Local Plan Part 1 refers to ‘intermediate’ housing, the NPPF no longer includes ‘intermediate’ within the definition of affordable housing. Instead it refers to Starter Homes [6 Starter homes are set to be replaced with First Homes. First homes will be sold at a discount of a minimum of 30% for first time buyers], Discount Market Sales and Other Affordable Routes to Home Ownership (including shared ownership, rent to buy and other low cost homes for sale). Further guidance on Discount Market

Sales housing is set out below.

In accordance with the Local Plan Part 1, tenures which enable home ownership for those who are excluded from the market are considered ‘intermediate’ and could contribute to the required proportion of affordable housing as set out in Policy 8 and paragraph 3.8.9 of the Local Plan Part 1.

2.10 A legal agreement (‘Section 106 Agreement’) and/or condition will set out the precise tenure restrictions applicable to a particular scheme and the discount which will be applied to properties which offer opportunities for home ownership.

Shared Ownership

2.11 Historically, within Rushcliffe, shared ownership tenures have comprised the majority of intermediate housing. These have been delivered alongside social and affordable rent properties which are all purchased together and managed by a Registered Provider.

2.12 The purchaser and occupier pay a mortgage on the share they own, and pay rent to a housing association on the remaining share. Because the purchaser only needs a mortgage for the share they are purchasing, the amount of money required for a deposit is usually a lot lower when compared to the amount that would be required when purchasing outright.

2.13 The purchaser has the option to increase their share during their time in the property via a process known as ‘staircasing’, and in most cases can staircase from 25% of the property all the way to 100% ownership. In this instance, the shared owner will no longer pay any rent, just their mortgage along with any service charges and ground rent.

2.14 Shared ownership properties offer opportunities for those who cannot purchase their own home as the rent paid to the Registered Provider is less than the rate charged on the open market, the deposit is between 5% and 10% of the share owned by the occupier and stamp duty can generally be deferred until the share reaches 80%.

2.15 Within specific rural locations, legal restrictions may prevent 100% ownership, in order to retain the property as an affordable home.

2.16 As with open market properties, residents of shared ownership dwellings may be required to pay management fees and service charges, depending on the development, the existence of shared spaces, and infrastructure. Residents must be made aware of these charges prior to purchasing the property.

Discount Market Sales

2.17 Discounted Market Sales housing provides a means for people to own their own home but without paying the full market price. The NPPF states that Discount Market Sales should be provided at a discount of no less than 20% below market value. In accordance with the NPPF this discount will be set according to local house prices and income levels. The level of discount should ultimately reflect

what is realistically affordable to a median or lower income household. Given the high property values within the Borough, this discount is likely to be greater than 20%, especially for those on lower quartile salaries. The discount should ‘run with the land’ such that if the house is sold on in future, the same level of discount will apply for future eligible buyers.

2.18 At the time of writing, Land Registry price paid data in 2021 (Jan to Sept) indicates that lower quartile sales prices in Rushcliffe are £170,000 and median sales prices in Rushcliffe are £270,000. As such assuming a 10% deposit and 4 x salary multiple, a single person household will require a gross income of £38,250 to access a lower quartile property (£170,000 - £17,000 (10%) / 4 = £38,250).

2.19 ASHE [Annual Survey of Hours and Earnings (Office for National Statistics)] data from 2021, however, shows that lower quartile resident annual gross incomes are £24,271 and median resident annual gross incomes are £34,425. This suggests that even single median-income residents may not be able to afford cheaper (lower quartile) properties in the Borough.

2.20 To consider the access thresholds (i.e. the property price that can be afforded) for discounted market products for single households the Borough Council applies 4 x times salary plus 10% deposit to assess the entry level thresholds at various salary multiples (lower quartile and median earners). This is illustrated in the table below. These assumptions mirror those used within the Greater Nottingham and Ashfield Housing Needs Assessment (2020) and are considered to be broadly in line with typical lending practices, although it is recognised that there will be differences on a case by case basis.

- Lower Quartile earner

- £24,271 multiplied by 4 = "£97,084 + £9,708 (10% deposit) - threshold is £106,792

- Median earner

- £34,425 multiplied by 4 = "£137,700 + £13,770 (10% deposit) - threshold is £151,470

2.21 To consider the access thresholds for discounted to market products for couple households the Borough Council apply 4 x times salary plus 10% deposit to assess the entry level thresholds at various salary multiples (lower quartile and median earners). This is illustrated below.

- Lower Quartile earner

- £24,271 multiplied by 4 = "£97,084 + £9,708 (10% deposit) - threshold is £106,792

- Median earner

- £34,425 multiplied by 4 = "£137,700 + £13,770 (10% deposit) - threshold is £151,470

2.22 Table 3 below includes the access thresholds identified above for lower quartile and medium earners and establishes the discount required in order to purchase a property of £170,000 (lower quartile), a £250,000 property and a £270,000 (median) property. This indicates a discount of 37% is required to enable a lower quartile single earner to own their own home. However a lower quartile couple household would not require a discount unless they require a £250,000 (15% discount) to £270,000 (21%) home. Median single earners require a discount greater than 20% if they are purchasing properties of £250,000 and £270,000. Median earning couple households would not require any discount when purchasing a property of £275,000 or less.

| Cohort |

Access price £ |

Lower Quartile - £170K Discount |

£250K Discount |

Median Discount |

|---|---|---|---|---|

| Lower Quartile single earner | £106,792 | 37.2% | 57.3% | 60.5% |

| Lower Quartile two earners | £213,585 | 0% | 14.6% | 20.9% |

| Median single earner | £151,470 | 11% | 39.4% | 43.9% |

| Median two earners | £302,940 | 0% | 0% | 0% |

2.23 Given the discount required to meet the needs of lower quartile earners, the Council’s preferred ‘intermediate’ tenure (Affordable Housing for Sale tenure) is shared ownership as this can be sold from 25% to 75% discount. The ability to staircase (gradually increase ownership) to 100% ownership also provides stability of ownership and more certain resale options. The sale of shared ownership properties to a single Registered Provider (who shares the ownership with the occupiers) reduces risks as uncertainties concerning the sale of other home ownership tenures to individual occupiers is avoided.

2.24 However if a planning application proposes Discount Market Sales as part of the affordable tenure mix, the Council will require any Discount Market Sales meet the needs of those on both lower quartile income ranges who are currently excluded from the housing market in Rushcliffe. Depending on the property, discounts will vary between 20% and 40%.

2.25 Rather than producing a series of average sales prices when a site comes forward, it will be contingent upon the developer to come forward with the proposed valuations and the discount that is being applied to each property (or property type).

2.26 Informed by the table above (and other up-to-date evidence of affordability), the Council will determine whether the proposed discounts meet the needs of lower quartile earners, who are currently excluded from the housing market. Properties that are less than £170,000 (for example flats) may not require a discount greater than 20% to be affordable to those on lower quartile earnings. The assessment of the Discount Market Sales affordability should be assessed by a RICS registered valuer. Clearly these valuations could be amended with agreement and prior to completion in the event that there is significant movement in the market.

2.27 Where Discount Market Sales are accepted, but viability constraints prevent sufficient discounts to meet the needs of those on lower quartile earners, a lower discount may be accepted if no alternative affordable housing tenure would address the viability issue and this is supported by a viability appraisal.

First Homes

2.28 On the 28 June 2021 the Government changed planning policy and included First Homes as a form of Discount Market Sales housing [Affordable Homes Update - Ministerial Statement May 2021]. This change is accompanied by the publication of Planning Practice Guidance on First Homes.

2.29 Whilst First Homes are a discount market sales tenure, Government policy requires First Homes are sold at a minimum discount of 30% against market value to first time buyers (the first sale no higher than £250,000 (outside Greater London)) as opposed to the minimum discount of 20% for Discount Market Sales housing. As shown in tables 1, 2 and 3 above, with the exception of single earners, a discount of 30% against market value should enable more households to afford median priced properties within Rushcliffe. However further evidence may indicate a higher discount of 40 or 50% may be required.

2.30 First Homes are the Government’s preferred discount market tenure, and national policy will require a minimum of 25% of a development’s required affordable housing contributions to be First Homes. In accordance with national guidance, the required proportion of social rented properties (19% of the borough’s affordable housing requirement (as set out in the Local Plan Part 1)) is

also ring fenced. This leaves the remaining 56% of the affordable housing contribution to be split proportionally between other ‘intermediate’ and affordable rented properties (based on the proportions set out in the Local Plan Part 1). This will reduce the requirement, as set out Local Plan Part 1, for affordable rent and other ‘intermediate’ or other routes to home ownership tenures. Where First Homes are included as part of an affordable housing contribution, the following tenures should be delivered:

- First Homes – 25%

- Social Rent – 19%

- Intermediate / Other Routes to Home Ownership – 29%

- Affordable Rent – 27%

2.31 The First Homes policy cannot be applied retrospectively to planning permissions determined before 28 December 2021, nor does it apply to those applications where there has been significant pre-application engagement (involving substantive discussions) which are determined before the 28 March 2022.

2.32 Unless exempt (e.g. substantive pre-application discussions took place and it is determined before the 28 March 2022), all applications which are required to make an affordable housing contribution (in accordance with the Local Plan) will be expected to include 25% of that contribution as First Homes.

Mix of Dwelling Sizes and Tenures

2.33 Local Plan Part 1 Policy 8 requires residential development should maintain, provide and contribute to a mix of housing tenures, types and sizes in order to create mixed and balanced communities. It specifically highlights the consideration of the needs and demands of the elderly as part of the overall housing mix.

2.34 Policy 8 Part 3 states that this mix will be determined according to evidence within the Strategic Housing Market Assessment, housing strategies, local demographics and trends, local evidence of need, local character and design considerations and the accessibility of a location.

2.35 As stated above in paragraph 1.16, the Council uses a housing needs model to determine the number of different affordable housing types and their tenures within each development. This is based upon evidence within the Strategic Housing Market Assessment (2012). However, in accordance with Local Plan Part 1 Policy 8 Part 3, if other evidence is provided which indicates a different mix of tenure and type would be more appropriate, or resolve viability issues, a variation of the mix may be accepted by the Council.

Design and Layout

2.36 As with all forms of residential accommodation, the Council expects affordable housing to be built to a high standard of design and amenity. Affordable housing provided within developments should be integrated with the market housing and the design and appearance should be indistinguishable from those market units and built using the same materials, form and quality of design to ensure that it

makes a positive contribution to local character and distinctiveness. This is often termed being ‘tenure blind’. Whilst this also applies to provision of parking spaces, which should be no different to that of market units, garages are often not provided for affordable homes.

2.37 Where a requirement for flats is identified as part of an affordable housing mix, applicants should consider whether two storey maisonettes offer opportunities to provide accommodation for single occupiers or couples. Maisonettes will often complement neighbouring two storey homes and residential layouts. They also provide separate entrances for occupants without shared spaces that can create management and maintenance issues for the property owners.

2.38 Plans submitted to the Council for planning consideration should clearly show the position of all affordable units within the development, except in those outline applications where only illustrative plans are submitted and the exact locations identified within subsequent reserved matters planning applications.

2.39 To achieve mixed, inclusive and sustainable communities, and comply with paragraph 92 of the NPPF, the affordable units should be ‘pepper potted’ throughout the site. ‘Pepper potting’ is the dispersal of affordable homes across a development site within individual groups, rather than in one distinguishable block where the residents of affordable housing are separated from residents within open market housing. The size of these groups will depend on the size of the development and the percentage of affordable housing expected in that location, but it is expected that they will not exceed 10 units. With the exception of 100% affordable housing schemes and rural exception sites, affordable housing should be grouped as follows:

- On sites below 30 residential units, are encouraged to provide them within two or more groups;

- On sites or phases incorporating 30 or more residential units they should be provided in groups of no more than 20% of the total number of units being provided or 10 affordable units, whichever is the lesser;

- On sites or phases incorporating 200 or more residential units, groups between 10 and 20 units may be acceptable where this delivers an inclusive mix of properties and a sustainable community.

2.40 Within 100% affordable housing schemes, different tenures (rented and home ownership) should be pepper potted across the development to avoid concentrations of tenure types and achieve mixed, inclusive and sustainable communities.

2.41 When deciding the location of affordable units within the site, properties with higher accessibility standards and bungalows should be located close to public transport infrastructure. All other affordable housing should be positioned as close as possible to public transport, consistent with the requirement to ‘pepper-pot’.

Phased Developments

2.42 Where a development is being brought forward in phases each phase should deliver the required proportion of affordable housing as set out in the Local Plan. This will ensure a wider distribution of affordable housing across the whole development and ensure affordable homes are delivered as early as possible.

Deferring the provision of affordable housing to later phases will not normally be permitted, unless this facilitates a better distribution of affordable homes within the development overall.

2.43 Outline planning permissions which will be delivered through separate reserved matters applications and or by different developers should include an overarching affordable housing strategy which identifies the broad distribution of affordable housing at each phase. Notwithstanding this requirement, the accompanying Section 106 Agreement should include the overall mix of affordable house types and tenures.

2.44 Each reserved matters application (phase) should include plans identifying the location, type and tenure of each affordable home. This will ensure compliance with Policy 8 of Part 1 Local Plan. The Section 106 Agreement will require that, prior to development commencing (at each phase if applicable), an affordable housing scheme should be submitted (and agreed by the local authority) with

information that identifies the Registered Provider which is purchasing the affordable housing and approximate completion date.

Occupancy Restrictions and Local Connections Criteria

2.45 The Council applies a criteria which requires a local connection or exemption to Rushcliffe for affordable housing in the Borough. The criteria for social and affordable rented housing are set out in the Choice Based Lettings and Housing Allocations Policy10. The criteria for local connection for other forms of affordable housing (home ownership tenures) are set out in the Section 106 Agreement or

Unilateral Undertakings, which, in accordance with Local Plan Part 1 Policy 8, require a proportion of affordable housing as part of an open market housing development. Consequently, wherever they are located in the Borough, these homes can be occupied by anyone with a local connection to Rushcliffe.

2.46 The Borough Council does not give additional preference to people that have a connection to that settlement at parish or ward level unless the proposal is a rural exception site which has been specifically granted planning permission, within a location where housing would not normally be permitted (for example within the Green Belt or countryside), to meet an identified local need (see

paragraphs 2.44 to 2.50).

Essential Local Workers

2.47 As set out in paragraph 1.8 above, the NPPF identifies essential local workers alongside those whose needs are not being met by the market as eligible for affordable housing. Essential local workers comprise those who provide frontline services in areas including health, education and community safety – such as NHS staff, teachers, police, firefighters and military personnel, social care and

childcare workers.

2.48 Should a proposal for affordable housing for essential local workers be submitted, the Borough Council will require similar occupancy controls and restrictions on removal of these controls as are applied to rural workers accommodation (as set out in paragraph 2.43). Where the lifting of conditions that restrict occupancy to essential local worker is sought and justified, it is expected that the properties should be made available to other residents who meet the criteria set out in the Choice Based Lettings and housing Allocations Policy or, if this is not appropriate, other residents whose housing needs are not being met by the market.

2.49 Depending on the occupiers (the essential local worker) and affordability, tenures may include rental, various routes to home ownership, Discount Market Sales and First Homes.

Agricultural, Forestry and Other Workers Requiring Rural Accommodation

2.50 Accommodation for rural workers may be permitted in the Green Belt, if, in accordance with national policy, very special circumstances exists. It may also be permitted within the countryside beyond the Green Belt outer boundary if it complies with Policy 22 of the Part 2 Local Plan. Those dwellings which are in principle acceptable beyond the Green Belt must comply with part 3 of Policy 22

which ensures the development conserve and enhance the character of the area.

2.51 With respect to tenure, an occupational tie provides in effect a form of ‘key worker housing’. As there is no requirement for such a dwelling to provide a low-rent or intermediate/low cost home ownership tenure, it does not automatically make a dwelling affordable. Such a dwelling can however be defined as ‘affordable’ if the tenure provided is in line with the definitions given in national policy.

2.52 With respect to rural workers, it is recognised that other rural employers may employ people whose presence on site is seen as integral to the long term viability of the business and the sustainability of the wider community to which it relates, but are not defined as agriculture or forestry workers. Dwellings for these workers may be permitted in accordance with Policy 22 part 2 a).

2.53 Whether the dwelling is temporary or permanent, is for an agricultural, forestry or other employee requiring accommodation within a rural location, the Borough Council will require evidence and justification for on-site accommodation, including:

- evidence of the necessity for a rural worker to live at, or in close proximity to, their place of work to ensure the effective operation of an agricultural, forestry or similar land-based rural enterprise (for instance, where farm animals or agricultural processes require on-site attention 24-hours a day and where otherwise there would be a risk to human or animal health or from crime, or to deal quickly with emergencies that could cause serious loss of crops or products);

- whether the proposed property is the appropriate size to meet the need identified;

- the degree to which there is confidence that the enterprise will remain viable for the foreseeable future;

- whether the provision of an additional dwelling on site is essential for the continued viability of the rural business. This may include ensuring farm succession;

- whether the need can be met by alternative accommodation in the locality; and

- whether the need could be met through improvements to existing accommodation on the site, providing such improvements are

appropriate taking into account their scale, appearance and the local context.

2.54 In order to assist the authority determine the above, the Council will employ an independent consultant to determine the financial and functional justification for on-site accommodation.

2.55 In the case of new enterprises, the Borough Council may consider granting permission for a temporary dwelling for a trial period, with such accommodation normally being a caravan or mobile home. The provision of temporary accommodation, normally over a three year period, offers the opportunity for the enterprise to become established while enabling operational needs to be met and confirmed prior to progression to a permanent dwelling if justified.

2.56 Where the accommodation is proposed by a rural estate (land owned by one person, family or organisation), the existence of an Estate Plan will potentially provide evidence of need.

2.57 If a need is justified and the proposal is acceptable, a condition restricting occupation to a rural worker in the locality will be imposed. This will reduce the market value of a property and make it more affordable to those who work in the rural economy. The lifting of these conditions will only occur if it is demonstrated that the property has been marketed at a realistic price (reflecting the occupancy restrictions and local wages) for a minimum six months and evidence provided that demonstrates that it is no longer required for a rural worker in the locality. This information will be assessed by an independent consultant.

Exception Sites

2.58 In accordance with Policy 8 of the Local Plan Part 1, rural exception sites will be permitted within or adjacent to rural settlements, provided robust evidence is provided of affordable housing needs, such as within an up-to-date Housing Need Survey. A Housing Need Survey will be considered out-of-date when it is greater than three years old, and any proposed exception site will require an updated survey.

2.59 Planning permissions for exception sites will be accompanied by a Section 106 Agreement which retains local connection restrictions on both rented or ‘intermediate’ (home ownership) properties. This ensures they remain available to local residents in housing need in perpetuity.

2.60 Policy 8 restricts the occupancy of affordable homes within exception sites to people that have a connection to that settlement (parish), who are in housing need and are unable to afford market housing within the settlement. For the purpose of local needs housing on a rural exception site a local connection is defined below:

- The applicant has lived in the parish for a continuous period over the last twelve months or three out of the last five years.

- The applicant has close family currently residing in the parish for at least 5 years. A close family connection is defined as mother, father, sister, brother or adult children. If none of the above exists other extended family members will be considered on condition that they are providing support to the applicant at the discretion of the Council.

- The applicant is currently employed in the parish for 16 hours per week or more and unable to enter the housing market within reasonable travelling distance for the employment.

- The applicant has, in the opinion of the Borough Council, outstanding personal reasons for residing in the Parish.

2.61 To satisfy the local connection criteria an applicant only has to meet one of the above points, although some may have more than this.

2.62 Occupants of properties for social or affordable rent must, in order to comply with Borough wide housing allocations policy, also comply with housing need and local connections criteria as set out in the Council’s Choice Based Lettings and Allocation Policy (see Occupancy Restrictions and Local Connections Criteria above). Occupants of intermediate (home ownership) properties are required to

meet one of the exception site criteria above only.

2.63 In accordance with Policy 8, a cascade mechanism enables other people in housing need, but who do not have a connection to the settlement, to occupy an exception site affordable home. If there are insufficient applicants meeting these criteria within the settlement, applicants from neighbouring villages/parishes meeting the local connection criteria will be considered as part of the nominations cascade agreement. If there are insufficient applicants meeting these criteria applicants with local connections to the Borough as a whole or anyone deemed in need by the Registered Provider will be considered.

2.64 Local connection criteria and the cascade mechanism will be included within a Section 106 Agreement that accompanies the planning permission. This agreement will require that the local connection restrictions apply in perpetuity and therefore apply to any resale or re-letting of an affordable dwelling within an exception site.

Entry-Level Exception Sites

2.65 Since adoption of the Local Plan Part 1, the NPPF has introduced entry-level exception sites. Entry-level exception sites must deliver homes that are suitable for first time buyers (or those looking to rent their first home), unless the need for such homes is already being met within the authority’s area.

2.66 These sites should be on land which is not already allocated for housing and

should:

- Comprise of entry-level homes that offer one or more types of affordable housing as defined in the NPPF (see paragraph 2.8);

and - Be adjacent to existing settlements, proportionate in size to them (no larger than one hectare or exceed 5% of the size of the

settlement), not compromise the protection given to Green Belts, and comply with any local design policies and standards.

Vacant Building Credit

2.67 The NPPF provides an incentive for brownfield development on sites containing vacant buildings. Where a vacant building is brought back into any lawful use or is demolished to be replaced by a new building, the developer should be offered a financial credit equivalent to the existing gross floor space of relevant vacant buildings when the local planning authority calculates any affordable housing contribution which will be sought. Affordable housing contributions may be required for any increase in floorspace.

2.68 For example where a building with a gross floorspace of 8,000 square metre building is demolished as part of a proposed development which has a gross floorspace of 10,000 square metres (+20% floorspace), any affordable housing contribution should be a 20% of what would normally be sought.

2.69 The vacant building credit does not apply to properties which have been abandoned. When considering whether a property is vacant (not in use and empty) or abandoned, the Council will consider the condition of the property, the period of non-use, whether there is an intervening use and evidence of the owner’s intention.

2.70 Properties which have fallen into significant disrepair (for example where roofing materials are missing, walls (internal and external) or ceilings have collapsed and/or there is vegetation within and over the property); been unoccupied for more than five years; and properties which have purposefully been left unoccupied by the owner will be considered abandoned by the Borough Council

and no vacant building credit will be applied.

Self and Custom Build Proposals

2.71 The Government is promoting self and custom build developments with the statutory requirement to maintain a self-build register and provide an appropriate number of serviced plots to meet identified need.

2.72 Most self-build plots will come forward on an individual basis or in some cases as a small group if it involves a self-build collective. Rarely would a self-build scheme involve 10 or more units in a single planning application, however, it may do so if a landowner applies for an outline application for a site of self or custom build plots.

2.73 Local and national policies do not differentiate between small scale developments and self-build in terms of affordable housing provision, with no specific exemption for self-build schemes from making a contribution. Consequently self-build sites of 10 or more will be subject to affordable housing requirements.

2.74 As with ‘traditional’ forms of housing developments, self-build proposals may not circumvent requirements to efficiently use a site by artificially subdividing sites. Should two or more separate planning applications for self-build or ‘traditional’ housing developments come forward within 5 years for adjacent sites within the same ownership and/or which have a clear functional link, the Borough Council

may conclude that the developments should be considered as a single scheme. The Borough Council will, in such cases, consider evidence including land transaction data, the closeness in time of the applications being made, and appropriate evidence of ownership at the times the respective applications were made.

Viability Appraisal

2.75 As stated above, and in accordance with paragraph 58 of the NPPF (2021), Rushcliffe Borough Council will, subject to viability assessments, negotiate amendments to the type and tenure of affordable units or a reduction in their number. If the delivery of affordable housing on-site is likely to raise viability issues, applicants are encouraged to contact the Council and enter pre-application discussions. Raising viability issues after an application has been submitted can significantly delay determination and may result in an

unfavourable decision.

2.76 Any viability appraisal should reflect the recommended approach in national planning guidance and this SPD, including the identification of the residual land values, the establishment of benchmark values, the use of standardised inputs, and should be made publicly available. Planning Practice Guidance makes clear that under no circumstances will the price paid for land be a relevant justification for failing to accord with relevant policies in the plan (Paragraph 011 Reference ID: 10-011-20180724).

2.77 Rushcliffe Borough Council operate an ‘open book’ approach regarding financial viability. Viability appraisals submitted in support of a planning application will be evaluated by a qualified land valuer on behalf of the Council, the cost of which will be paid for by the applicant. The Council will shortlist three land valuers to undertake an evaluation of the viability appraisal. The applicant will select the

land valuer from this shortlist. The chosen valuer should not have any previous involvement with the development proposed.

2.78 The starting point for a viability appraisal is to establish the ‘residual land value’ for the site being developed. This is the amount that the developer can afford to pay for the development site, once all reasonable costs have been met. It is the difference between the values of the completed development on the one hand (Gross Development Value), and the overall cost of the development on the

other. The residual land value approach should be followed when calculating the commuted sum (see Financial Contributions below).

2.79 The gross development value should include any rental incomes, the sale of properties, and any subsidies and grants.

2.80 The reasonable cost of development should include construction costs, site costs (landscaping, roads and infrastructure), planning obligations (including affordable housing), professional fees, finance, sales and profit. Abnormal cost which are unique to the development should not be included within the cost of development as these costs should be reflected in the land value and absorbed

by the landowner.

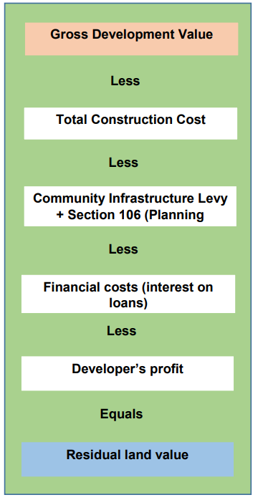

2.81 Calculating residual land value:

Gross Development Value less,

- Total Construction Cost, less

- Community Infrastructure + Section 106, less

- Financial costs (interest on loans), less

- Developer's profit, equals

- Residual Land Value

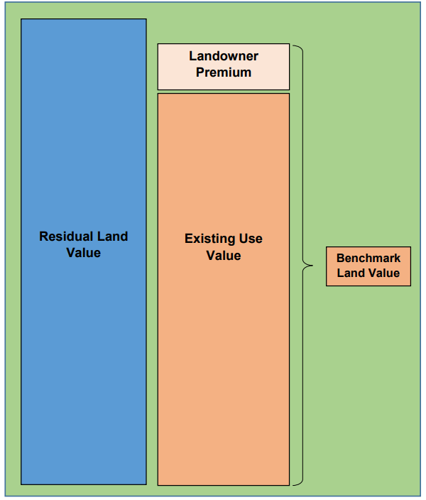

2.82 To establish whether a scheme is viable, the residual land value is compared with a benchmark land value. This is defined as the value of the site in its existing use (the ‘existing use value’), plus a ‘premium for the landowner’ which is the minimum return at which it is considered a reasonable landowner would sell their land for development.

2.83 The diagram below identifies a proposal where the residual land value exceeds the benchmark land value and is therefore viable.

2.84 When assessing the viability of a scheme, a number of key inputs are required. The content for an applicant’s viability appraisal is set out in national planning practice guidance. The Residual Land Value should be supported by evidence from comparable development land sales. (This can provide a sense check but should also consider adjustments to factor in newly adopted planning policies.) In addition, the Council will expect confirmation of the price paid for the property/land or the price expected to be paid for the property/land on the grant of planning permission together with confirmation of the contractual terms relevant to the determination of the purchase price within any contingent sale agreement or option agreement including minimum price and overage provisions. Price paid is not allowable evidence for the assessment of benchmark land value and cannot be used to justify failing to comply with policy.

3. Financial Contributions

Acceptance of Financial Contributions

3.1 To ensure delivery of affordable housing it is expected that they will be provided

on site alongside the open market housing. Discussions regarding alternative off-site delivery on a ‘donor site’, or, as a last resort, commuted sums (financial

payment) will take place in exceptional circumstances. These circumstances

exist where:

- An independent viability assessment confirms delivery on site is not viable;

- No Registered Provider is willing to purchase the affordable unit(s); or

- Delivery of off-site or a commuted sum would deliver more sustainable development and/or more affordable units.

3.2 Registered Providers are regulated by the Regulator of Social Housing. They build, purchase and manage social, affordable and intermediate (shared ownership) housing. If an applicant is unaware of the Registered Providers which operate within the Borough or has been unable to secure the sale of the affordable unit(s), the Borough Council can provide a list of these Registered Providers.

3.3 If off-site provision is agreed for reasons other than viability (see paragraph 3.1 (c) above) the Council will seek to maintain the ratio between affordable and open market housing required by Policy 8 within the donor site or equivalent financial payment.

3.4 The financial contribution will be paid into a ring-fenced fund which will be used to contribute to the overall affordable housing provision in the Borough through a range of projects such as supporting the development of rural affordable housing (within exception sites), enabling any specialist housing provision such as supported housing, forward / gap funding schemes, improving tenure mix /

affordability, and empty homes / refurbishments. This is not an exhaustive list and the fund can be used to support new innovative ways to contribute to increasing affordable housing provision including the consideration of viability assessments submitted with an application to ensure the maximum number of affordable units are secured. It is expected that any commuted sum will be subject to repayment provisions and these will be set out within the Section 106 Agreement.

3.5 The payment and spending of financial contributions is monitored by Rushcliffe Borough Council’s Planning Contributions Officer.

Calculating the Financial Contribution

3.6 In accordance with the NPPF this supplementary planning document is not prescriptive, rather it sets out principles which should be followed whilst undertaking viability assessments and determining an appropriate commuted sum. This provides flexibility when dealing with housing proposals that vary significantly in location, scale, type and tenure.

3.7 The calculation of the commuted sum should be based upon the residual land value approach to viability (see above) with the gross development value of the proposal (based on local housing market evidence) compared against the combined cost of purchasing the land, construction, planning obligations and a competitive return for the developer.

3.8 The required sum will be determined according to the difference between the financial return (profit) (gross development value minus all reasonable costs) for the developer of the proposal with the affordable units on-site and the proposal without them.

3.9 The calculation of the commuted sum will be informed by:

- the particular circumstances of the site;

- the residential scheme proposed;

- current construction and finance costs;

- current house prices and land values; and

- current national and local policy requirements, including Community Infrastructure Levy (when adopted) and affordable housing

requirements.

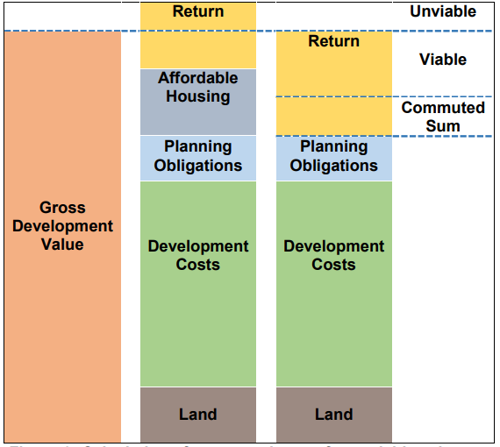

Unviable Proposals

3.10 The diagram below illustrates the calculation of the commuted sum where the combined costs of the development (including affordable housing) exceed the gross development value and therefore does not provide an acceptable competitive return and the scheme is therefore unviable. In the example below a reduction in the number of affordable units is not achievable. It is therefore

judged acceptable to forego on-site provision of affordable housing and accept a commuted sum which is less than the cost of providing a policy compliant number of units on-site. The commuted sum will provide a competitive return and no more. Not accepting an appropriate commuted sum would prevent the development coming forward.

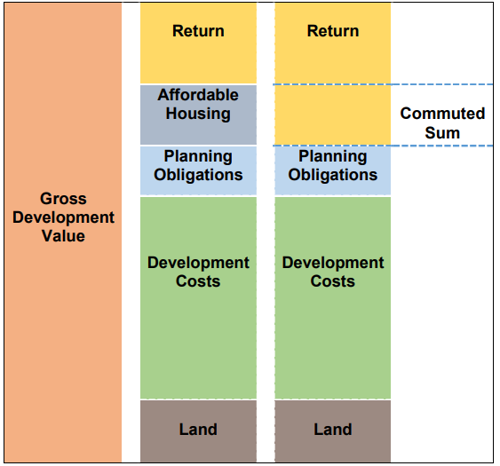

Viable Proposals

3.11 The diagram below simplifies the calculation of commuted sums where the delivery of affordable housing on site is viable but a registered housing provider is unwilling to purchase the properties, or where the provision of off-site affordable units would be more sustainable.

3.12 Where Registered Providers are unwilling, evidence that all local Registered Providers have been approached will be required before discussion regarding commuted sums occurs.

4. Securing Affordable Housing Contributions

Section 106 Agreements and Unilateral Undertakings

4.1 The Council will usually secure affordable housing requirements through entering into a legal agreement pursuant to section 106 of the Town and Country Act 1990 (as amended) with the developer or landowner. On occasions the affordable housing will be secured by way of Unilateral Undertaking under Section 106 of the Town and Country Planning Act (1990) (as amended) (“a Section 06 agreement) in the event of a planning appeal. The Council may also secure affordable housing by way of planning condition, but this is not the

preferred approach.

4.2 The affordable housing clauses in the Section 106 agreement will usually include

obligations relating to:

- the size, type, tenure, location, design and layout of the affordable housing;

- the number (or percentage) of affordable dwellings to be delivered;

- limitations on the occupation of the affordable housing;

- nomination rights;

- triggers relating to the delivery of affordable housing (construction and completion) in relation to the delivery of market housing;

- the retention of the housing as affordable;

- obligations relating to the affordable dwellings for first and subsequent residents;

- requirements to replace the affordable dwellings and for subsidy recycling;

- continued use of affordable dwellings in perpetuity;

- mortgagee in possession (MiP) clauses that allow the purchase or repossession of the property where the owner defaults; and

- review (clawback) provisions, where relevant.

4.3 The Section 106 Agreement will contain a clause(s) that trigger the delivery/payment of the contribution. This will usually be the commencement of development, completion and/or occupation of a percentage of the development, and will be set out in the obligations. For example the Council will require submission of an affordable housing scheme prior to commencement (once approval has been granted either in full or following reserved matters). Commencement of construction and completion of the affordable housing will also be required within specific periods during the delivery of the development, or within individual phases. Unless agreed otherwise, the Borough Council will require commencement of construction of the affordable housing before 40% of the open market dwellings (whole of the development or phase) are occupied and completion of the affordable homes before 60% of the open market dwellings (whole of the development or phase) are occupied.

4.4 However, in some circumstances it may be acceptable to agree different delivery timescales where the layout of the development, the location of the affordable housing within it, phasing, and/or construction programme would not facilitate the commencement and completion of the affordable homes before 40% and 60% of the open market dwellings are occupied.

4.5 The Council expect that any draft S106 or template provided by the Council will be utilised.

Registered Providers

4.6 Within Rushcliffe the majority of affordable homes are owned and managed by Registered Providers (also known as housing associations). Typically these providers purchase the affordable homes, which are required as part of larger housing development, in accordance with local plan policies. Commonly referred to as affordable housing contributions their delivery, occupancy and resale

requirements are set out in Section 106 Agreements that accompany the planning permission (see above).

4.7 In some circumstances a Registered Provider may develop sites for affordable housing only (i.e. 100% affordable housing). In these circumstances a Section 106 Agreement will be required to manage occupancy and resale.

4.8 A list of Registered Providers can be obtained by contacting the Strategic Housing Team at Rushcliffe Borough Council.

4.9 Where an affordable housing contribution is required, the applicant or developer responsible for delivering the dwellings will be expected to approach the Registered Providers operating within the Borough Council and offer these units for sale. The offer must include the mix of house tenures and types within the approved development, or, if approval has not yet been granted, a mix that is

agreed in writing by the Council.

4.10 If no Registered Provider agrees to purchase the affordable units, the applicant/developer must provide the Registered Providers responses. Where evidence is provided that indicates that a different house type and/or tenure would be purchased, this will be taken into consideration when negotiating a different mix. Where the price of the affordable units is a constraint on the purchase, this will not be considered a valid reason for renegotiating a different mix, as it is expected that a policy compliant and viable house type and tenure

mix would have been considered prior to the application being submitted.

Proposals without a Registered Provider

4.11 In accordance with national policy, affordable homes may be owned and managed by other Non-Registered Providers, provided the homes meet the definition of affordable housing. For example home ownership tenures may be privately owned. Where it is proposed that the completed units are not to be transferred to a Registered Provider the Council will need to be satisfied that, provisions are in place to ensure that:

- the affordable housing will remain at an affordable price for future eligible households or;

- the value of the subsidy or discounted price is recycled for alternative affordable housing provision. These provisions will usually take the form of covenants within any S106.

4.12 If, in any type of scheme, it is proposed that a Registered Provider is not to be involved in the management of affordable housing, the Council will usually secure the provision of affordable housing for successive occupants through the use of planning obligations, restricting occupancy to households who cannot compete in the housing market. If a Section 106 Agreement has already been entered into prior to the scheme being submitted, the Council will require a deed of variation to be entered into to provide the additional provisions outlined above before the Scheme will be approved.

Affordable Housing Scheme

4.13 As set out in paragraph 4.2 above the Section 106 Agreement should contain information regarding the number, type and tenure of the affordable homes. Prior to the commencement of a development that includes on-site affordable housing contributions, the Borough Council will also, through the Section 106 Agreement, require the submission of an Affordable Housing Scheme that delivers the

affordable homes required within that Section 106 Agreement. Failure to submit an affordable housing scheme in accordance with the trigger within the Section 106 agreement will result in enforcement action. An Affordable Housing Schedule Template is included in Appendix 1 and applicants/developers are encouraged to use this template.

4.14 Directed by the Section 106 Agreement, the Affordable Housing Scheme must include the following information:

- Layout plan identifying the location of each affordable dwelling and its house type and tenure.

- Affordable Housing Scheme identifying the tenure, plot number, type of home, number of bedrooms and expected construction completion date of each affordable home.

- Details of the registered housing provider who will be purchasing any rented properties or shared ownership properties. Confirmation that the Registered Providers have signed a nominations agreement with the Council, who will determine who will occupy the properties.

- If discount market sales are accepted as a proportion of the affordable housing mix, details regarding the sale price and the

discount in value against open market values should be included.

Delivery within Small or Isolated Sites

4.15 The Council expects an affordable housing contribution in accordance with the Local Plan wherever the site is located. Within rural villages and/or on small sites, it may prove difficult attracting interest from Registered Providers due to increased maintenance costs per dwelling and potentially less interest from prospective tenants.

4.16 Where an applicant or developer is unable to secure the purchase of their on-site affordable housing contribution, and written evidence is provided which proves the required mix is not attractive to the Registered Providers, the Council will firstly renegotiate a different mix of affordable housing tenure and types. For example, within rural villages, a greater proportion of shared ownership

properties are often more likely to attract occupation and avoid management costs which accompany rented properties. If no provider is interested in a revised mix, the Borough Council will consider a commuted sum.

Review (Clawback) Mechanisms

4.17 As viability appraisals are by their nature estimates, the actual viability of the development can only be properly and fully determined when the dwellings have been completed and sold. The nature of residual land valuation is such that they use currently achieved rentals and values in the vicinity and they do not take into account future growth in the value of the development when it is completed and has improved the environment where it is situated. Therefore, where the Local Planning Authority has agreed to reduce the affordable housing requirement and an increase in property values may occur (for example on larger sites that may take several years to develop), a clawback obligation will be incorporated within the S106 agreement to ensure that, if the housing development proves to be viable and profitable. Depending on the scale of development, re-appraisals of profits will occur either when individual phases (on larger schemes) or the whole development is completed and sold. If an increase in profit is identified the appropriate proportion of these profits will then be secured for affordable housing provision.

4.18 It is likely that this provision will be off-site through a commuted sum, unless the development is of a sufficient size and/or being delivered in phases which can make up the shortfall which was agreed when the application was permitted.

4.19 As with the original viability appraisal, re-appraisals of viability and assessment of actual profits will be undertaken by an independent land valuer. The Council will offer the applicant three prospective valuers to choose from and the appraisal will be undertaken at the applicant’s expense.

5. Contact Details

5.1 For further information regarding this Supplementary Planning Document and the delivery of affordable housing within Rushcliffe please contact either:

Planning Policy

Rushcliffe Borough Council

Rugby Road

West Bridgford

Nottingham

NG2 7YG

0115 981 9911

localdevelopment@ruschcliffe.gov.uk

Or

Strategic Housing

Rushcliffe Borough Council

Rugby Road

West Bridgford

Nottingham

NG2 7YG

0115 981 9911

affordablehousing@rushcliffe.gov.uk